TMS Implementation Pitfalls: The Hidden Costs That Derail European Shipper Budgets

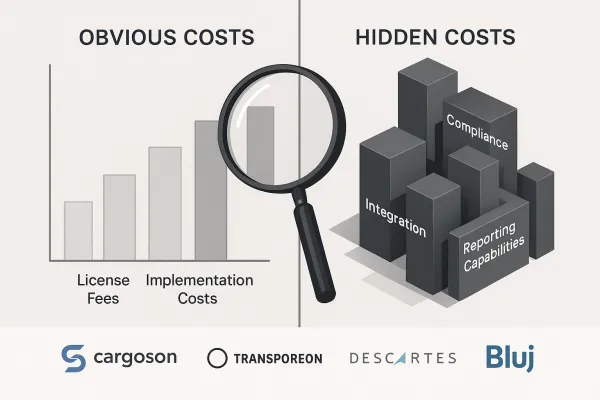

Budget overruns hit 75% of European TMS implementations, yet most shippers focus only on subscription costs when evaluating systems. The reality? Implementation costs range from €30,000 to €900,000, and for shippers with freight spend exceeding $250M annually, implementation can cost 2-3 times the subscription fee.

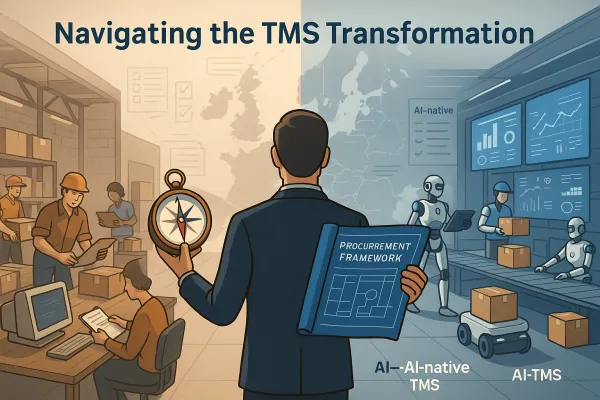

The procurement mistakes that drain budgets aren't hidden in fine print. They're systemic gaps in how European shippers approach TMS selection and contract negotiation. Here's how to identify, negotiate around, and ultimately control these expenses before they appear on your balance sheet.

Why TMS Implementations Fail to Meet Budget Expectations

European shippers consistently underestimate TMS implementation costs because they conflate software subscription fees with total project expense. The "long pole of the tent" of implementation time, and therefore cost, resides in the design, build, and testing of integrations.

The math works against most buyers from day one. A basic domestic shipper needs 10-15 integrations minimum, totaling 1,000-1,500 hours of labor, while most shippers today require an average of 40 integrations. Some complex implementations record over 140 integration objects.

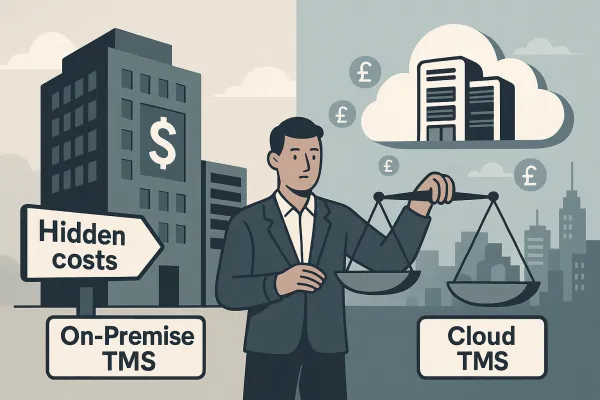

Annual maintenance fees present another budget trap. Licensed TMS models include annual maintenance charges ranging from 15-20% of license costs, while traditional software maintenance fees often run around 20% of the license fee annually for support and minor upgrades.

Consider how MercuryGate, Descartes, and Manhattan Active structure their enterprise offerings versus streamlined alternatives. Manhattan's total cost of ownership ranks as relatively high, while cloud-native solutions like Cargoson focus on reducing implementation complexity through pre-built integrations and European carrier connectivity.

Integration and Connectivity: The €50K+ Surprise

Carrier integration costs blindside most procurement teams because vendors present API availability as "included" functionality. The reality proves more expensive. While many TMS solutions offer published APIs, carriers are often unwilling or unable to create connections themselves, and even when they can, they typically charge integration costs back to the shipper.

These charges vary dramatically by provider approach. Transporeon and nShift require carriers to implement standard EDI interfaces themselves, while Cargoson builds true API/EDI connections with carriers rather than requiring standardized EDI messages that carriers must implement.

The result? Shippers pay additional fees to integrate with third-party applications, such as SMC license or PC Miler license fees. Integration costs vary wildly among TMS vendors, with some charging large fees to integrate with other applications because they haven't developed core applications to be easily extendable.

Smart buyers negotiate carrier integration costs upfront and prioritize TMS providers with extensive pre-connected networks to control connectivity expenses.

Contract Terms That Multiply Your TMS Investment

Legacy licensing models trap European shippers in expensive maintenance cycles that compound annually. Licensed TMS software costs $50,000-$400,000+ and typically includes annual/monthly maintenance and support fees. The maintenance burden doesn't decrease as systems age.

Oracle TM and SAP TM exemplify this pricing complexity through multi-layered fee structures that include base licenses, user counts, transaction volumes, and regional modules. Compare this to subscription models where costs scale more predictably with usage.

Scaling limitations create additional expense through artificial constraints. Unlike per-user or per-transaction SaaS models, cloud-based TMS typically charges as a percentage of Freight Under Management (FUM), allowing customers to use the TMS without artificial restraints.

The procurement strategy should evaluate total contract value over 5-7 years, not just year-one costs. Factor in user additions, module expansions, and integration requirements that emerge as operations mature.

The "Free" TMS Trap: When Zero Upfront Becomes Maximum Expense

Free TMS offerings create the most expensive buyer remorse in transportation software. From a freedom perspective, shippers using "free" TMS cannot go outside the software options to bring in their own motor carrier relationships because it's not allowed under the free plan.

These limitations force costly workarounds or complete system replacements. Free trial and free TMS software options come with limitations and are meant to entice users to upgrade to paid versions with more advanced features.

The upgrade pressure becomes intense once operational dependence develops. Transaction fees, feature restrictions, and support limitations gradually reveal the true cost structure, often exceeding what full-featured alternatives would have cost initially.

Implementation Governance: Avoiding the Downtime Risk

Poor implementation planning creates operational risks that dwarf software costs. Manufacturing and distribution operations face significant downtime exposure during TMS transitions, requiring careful testing phases and change management protocols.

Cloud TMS platforms help avoid typical implementation pitfalls, with average installations taking two to three months maximum, compared to licensed software that takes longer to implement and requires extensive upfront planning, as each install represents a greenfield startup where everything must be configured from scratch.

Blue Yonder and Manhattan Active implementations typically require extensive project management resources and testing protocols. In contrast, solutions like Cargoson focus on European manufacturers, wholesalers, and retailers with direct API/EDI integrations across all transport modes, specifically addressing challenges that manufacturing, wholesale, and retail companies face.

Implementation governance should include dedicated project management, comprehensive testing phases, and rollback procedures. The cost of getting this wrong exceeds the expense of proper planning by orders of magnitude.

Data Migration: The Silent Budget Killer

Data migration failures create accuracy issues requiring extensive cleanup and rework. Historical shipment data, carrier contracts, and rate information must transfer cleanly to maintain operational continuity.

Validation costs emerge when legacy data doesn't map properly to new system structures. ERP integration complexity multiplies when data formats require transformation or cleansing before import.

Backup and recovery requirements demand additional infrastructure and testing to ensure business continuity throughout the migration process.

Procurement Strategies to Control TMS TCO

Advanced TMS modeling predicts contract impact before signature. CTSI-Global's Honeybee TMS can load carrier proposed rates and terms into its modeling engine to predict how contract changes impact factors like shipper final spend and pricing rigidity, comparing results to partner rates and market alternatives.

RFP templates should address integration requirements, carrier connectivity, and scaling provisions explicitly. Cost modeling approaches need to account for implementation services, ongoing support, and future expansion requirements.

Contract negotiation tactics focus on controlling variables that multiply over time. Negotiate caps on annual maintenance increases, define integration cost responsibility clearly, and establish performance penalties for project delays.

Evaluation frameworks comparing Alpega, E2open/BluJay, FreightPOP, and Cargoson should weight implementation complexity alongside feature functionality. Limiting the number of solution vendors involved in overall TMS implementation has the most impact on implementation time, costs, and required expertise.

Red Flags in TMS Vendor Contracts

Scalability clauses that penalize growth represent the most expensive contract trap. Long-term contracts often include financial penalties for early termination, while data portability issues make migrating information prohibitively complex.

Support limitations emerge through tiered service levels that restrict access to technical resources when issues arise. Integrations developed without proper architecture cause instability with core code and require ongoing maintenance and support, which vendors bill monthly or annually.

Exit costs include data export fees, contract termination penalties, and transition assistance charges. These unfavorable terms create intangible opportunity costs or financial expenses, with "data portability fees" potentially reaching millions of dollars to leave.

The most dangerous clause? Workflow mismatch provisions that weren't identified during evaluation. Many shippers choose sleek, modern, inexpensive solutions only to discover misalignment with their workflow, leading to manual workarounds and contract termination within months.

Contract red flags include automatic renewal clauses without negotiation periods, pricing escalation formulas tied to vendor metrics rather than market indices, and integration fees that increase with system usage rather than remaining fixed.

Your procurement strategy should include detailed workflow documentation, pilot testing with actual shipment data, and contract terms that protect against vendor lock-in. Negotiate provisions for obtaining data in usable formats upon termination, and consider paying slightly more for providers supporting hybrid deployments or transition assistance to prevent lock-in.

European shippers can control TMS total cost of ownership through disciplined procurement practices that account for the full implementation lifecycle, not just subscription fees. The difference between budget success and failure lies in understanding these hidden costs before the contract signature, not after the invoice arrives.