TMS Pricing: What the 'Per-Shipment' Model Really Costs in EU

Now I have sufficient information about both eFTI compliance and TMS pricing to write the article. Let me create the blog post according to the guidelines.

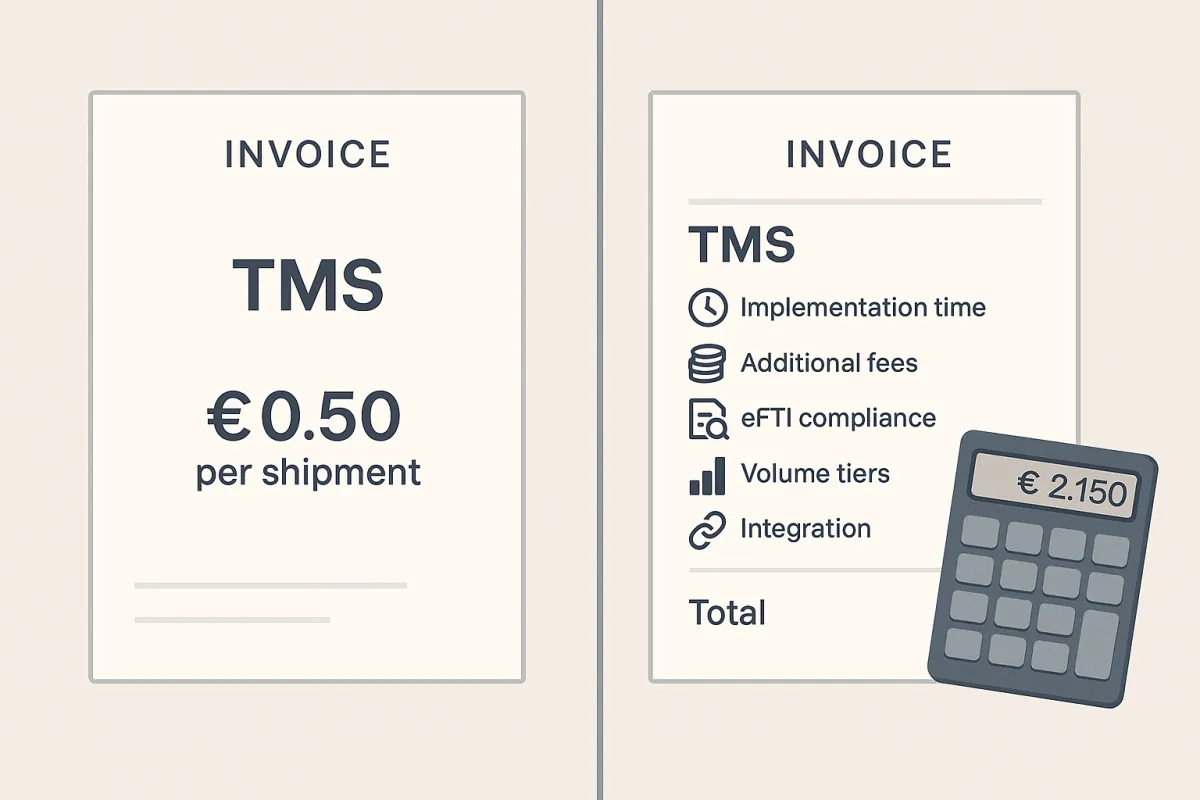

You've received three TMS quotes for your EU operation. One vendor promises "€0.50 per shipment" - another pitches "competitive per-transaction rates" - the third offers "transparent pricing with no hidden costs." Six months after implementation, your actual costs exceed initial projections by 25-30%. Sound familiar?

The reality hits procurement teams hard: transaction-based TMS pricing ranges from €0.25 to €4.00 per shipment, but the final figure depends on factors most vendors conveniently omit from their sales presentations. Add mandatory eFTI compliance requirements by July 9, 2027, and you're looking at budget calculations that become exponentially more complex.

This guide breaks down the real costs behind per-shipment TMS models and provides a framework for building accurate TCO projections that account for Europe's approaching digital freight mandate.

The Hidden Reality of Transaction-Based TMS Pricing

Most European shippers receive quotes showing neat per-transaction fees. The marketing materials highlight scalability - pay only for what you use. The reality proves messier.

A company processing 1,000 shipments annually pays higher per-transaction fees than one processing 1 million shipments. The per-transaction cost decreases with volume, but the total expense increases. This sliding scale creates budget uncertainty for growing businesses.

Here's what the math looks like across different volume tiers:

- 1,000-10,000 shipments: €2.50-€4.00 per transaction

- 10,000-100,000 shipments: €1.00-€2.50 per transaction

- 100,000+ shipments: €0.25-€1.00 per transaction

But volume tiers represent just one cost variable. The fee per shipment varies by transport mode and required solution features. Road freight typically costs less per transaction than multi-modal shipments. Parcel integration commands premium rates. Cross-border functionality adds another layer.

The market includes established players like MercuryGate and Descartes alongside newer entrants like Cargoson, each with different approaches to transaction pricing. Some bundle visibility features into base rates. Others charge separately for tracking capabilities.

eFTI Compliance: The €1B Question for Your Budget

The EU transport sector could save up to €1 billion annually through eFTI implementation, but individual companies face upfront compliance costs that most TMS quotes don't address.

Member State authorities must accept electronic information via certified eFTI platforms starting July 9, 2027. This isn't optional - it's mandatory for freight operators wanting to avoid paper documentation burdens during inspections.

Your TMS selection directly impacts eFTI readiness. Business data must be housed on secure, certified IT platforms that integrate with existing data management systems. Not every TMS vendor offers native eFTI functionality. Some require third-party platform connections - adding integration costs and ongoing fees.

The compliance timeline creates procurement urgency:

- January 2026: eFTI platforms can start operations

- Member States may begin accepting certified platform data

- July 9, 2027: Full eFTI Regulation enforcement

Companies selecting TMS solutions now must evaluate eFTI compatibility as a core requirement, not an add-on feature. The clock is ticking.

Hidden Cost Category 1: Integration and Setup Fees

Transaction-based pricing quotes typically exclude integration expenses. Basic API integrations cost €5,000-€15,000, while complex ERP connections exceed €50,000.

A basic domestic shipper requires 10-15 integrations minimum, potentially totaling 1,000-1,500 hours of labor. More complex operations may need 140+ integration objects.

The math becomes stark: for shippers with annual freight under management exceeding €250M, implementation costs often run 2-3x the subscription fees.

Integration complexity varies by vendor architecture. Legacy systems require custom development work. Modern platforms offer pre-built connections but may charge activation fees for each carrier or service provider link.

Additional fees cover third-party application integration, such as SMC or PC Miler license costs. These aren't one-time expenses - many require ongoing licensing fees.

Hidden Cost Category 2: Volume Tier Traps

Per-shipment pricing creates a psychological trap. Growing businesses see lower unit costs as volume increases, but often freeze when spreadsheet projections show higher total costs over several years compared to licensed TMS options.

The tier structure penalizes rapid growth. A company processing 5,000 shipments monthly at €2.00 per transaction pays €120,000 annually. Scale to 15,000 monthly shipments, and even at reduced €1.50 per transaction rates, annual costs jump to €270,000.

Volume volatility amplifies this challenge. Seasonal businesses face budget unpredictability. Transaction fees depend on total monthly shipments, but forecasting accuracy becomes difficult during market fluctuations.

Some vendors offer protection through volume commitments or ceiling arrangements, but these typically require annual contracts with minimum spend guarantees.

Hidden Cost Category 3: Ongoing Maintenance and Support

Traditional licensed TMS models charged around 20% of license fees for annual maintenance. Transaction-based systems embed these costs differently - sometimes invisibly.

Companies face ongoing costs for system updates, troubleshooting, and technical support that accumulate over time. Cloud-based TMS vendors include these in transaction fees, but service levels vary significantly.

Labor represents one of the biggest hidden costs. TMS platforms are notorious for difficult interfaces - teams spend extra hours weekly performing tasks that could be faster with better user experience.

Support quality directly impacts operational efficiency. Premium support costs extra, but standard support may involve long response times or limited availability during European business hours.

Building a Realistic TCO Model: 5-Year View

Accurate TMS cost projection requires comparing different pricing models across realistic timeframes. Here's a framework for building comparative analysis:

Cloud Transaction-Based Model:

- Year 1: Integration costs (€15,000-€75,000) + transactions

- Years 2-5: Transaction fees + support + feature additions

- eFTI compliance: Included or additional platform fees

Licensed Model:

- Year 1: License (€50,000-€500,000) + implementation + hardware

- Years 2-5: 15-20% annual maintenance + upgrade costs

- eFTI compliance: Third-party platform integration required

Managed Service Model:

- All years: Fixed monthly fee covering software + operations

- eFTI compliance: Typically included in service scope

Research shows companies implementing TMS solutions often see significant freight cost reductions, but TCO calculations must account for the full cost spectrum beyond software licensing.

Your downloadable TCO template should include separate line items for eFTI compliance costs, whether built into transaction fees or charged separately. The approaching mandate makes this a required expense, not optional functionality.

Procurement Playbook: Questions That Surface True Costs

The right RFP questions expose pricing reality before contract signature. Here are the specific queries that reveal hidden costs:

Transaction Pricing Questions:

- "What's the exact per-shipment cost for our projected volume range +/- 25%?"

- "How do tier thresholds work if volume fluctuates monthly vs. annually?"

- "Which features are included in base transaction fees vs. charged separately?"

eFTI Compliance Questions:

- "Is eFTI functionality native to your platform or provided by third parties?"

- "What additional costs apply for eFTI platform certification and ongoing compliance?"

- "When will eFTI features be available for testing and validation?"

Integration Cost Questions:

- "Provide a detailed breakdown of integration costs for our specific ERP and carrier network"

- "Which integrations are pre-built vs. requiring custom development?"

- "What ongoing fees apply for each integration after initial setup?"

Create a vendor comparison matrix including established players like Alpega, E2open, and Manhattan Active alongside emerging solutions like Cargoson. Include separate columns for transaction costs, integration fees, eFTI readiness, and total 5-year TCO projections.

The most telling question: "What would our actual monthly invoice look like in month 6, 12, and 24 based on our volume projections?" Vendors confident in their pricing transparency will provide detailed breakdowns. Others will deflect or provide vague estimates.

Your next step: build that TCO model now, before the eFTI deadline creates time pressure that compromises your negotiating position. The vendors with genuinely transparent pricing will welcome the scrutiny. The others will reveal themselves quickly enough.